The Holding Company: A Powerful Business Structure You Need To Know About

So, you've probably heard the term "the holding company" thrown around in business circles, but do you really know what it means? Imagine this: a single entity that owns other companies or assets without engaging in day-to-day operations itself. Sounds intriguing, right? Well, it's not just some fancy business buzzword—it's a strategic structure used by some of the biggest names in the corporate world. Whether you're an entrepreneur looking to expand your empire or an investor seeking to diversify your portfolio, understanding holding companies can be a game-changer.

Now, let's break it down in simple terms. A holding company is like the parent in a corporate family. It doesn't produce goods or services directly but instead owns the stocks or assets of other companies. This setup allows for better risk management, tax efficiency, and overall control over a diverse range of businesses. Think of it as having a portfolio of companies under one roof, where you can manage them strategically without getting your hands dirty in the operational nitty-gritty.

Here's why this structure matters to you. Whether you're planning to scale your business, protect your assets, or even explore new markets, a holding company offers flexibility and security that traditional business models often lack. And with the global corporate landscape becoming increasingly complex, having a solid understanding of how holding companies work can give you a significant edge. So, buckle up because we're about to dive deep into the world of holding companies and uncover why they're such a powerful tool in today's business environment.

Read also:Unbelievable Story Of The 188yearold Man Rescued A Journey Through Time And Survival

What Exactly is a Holding Company?

Alright, let's get into the nitty-gritty. A holding company is essentially a legal entity that owns the majority—or sometimes all—of the voting stock in other companies. This means it has control over those companies without actually being involved in their day-to-day operations. It's kinda like being the boss without having to do the boss stuff. The beauty of this structure is that it allows for centralized management while maintaining operational independence for the subsidiaries.

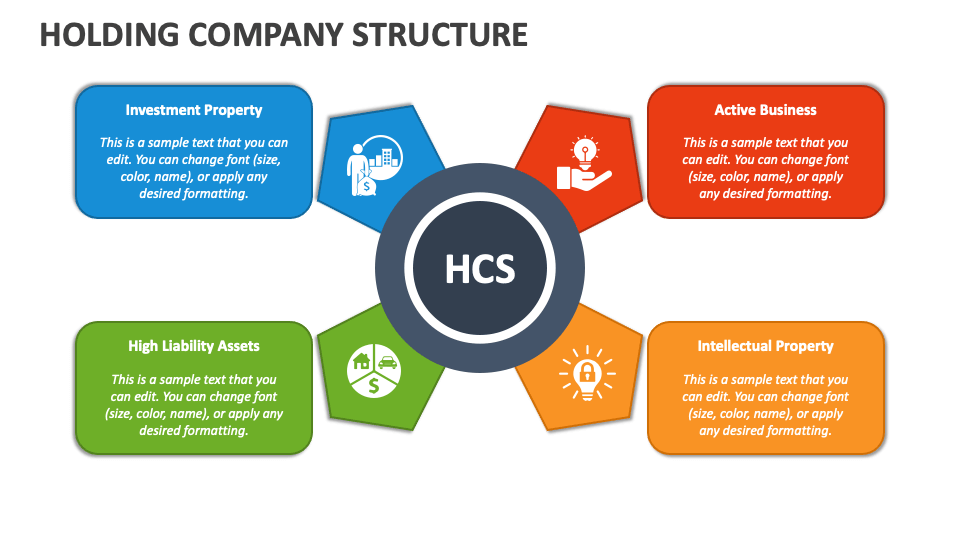

Now, here's where it gets interesting. Holding companies can hold various types of assets, not just stocks. They can own real estate, patents, trademarks, and even intellectual property. This diversification helps mitigate risks because if one subsidiary struggles, the holding company can still rely on the others to keep things afloat. It's like having multiple streams of income under one umbrella, which is pretty smart if you ask me.

How Holding Companies Operate

So, how exactly do these holding companies function? Well, they operate through a hierarchical structure where the holding company sits at the top, making high-level decisions like appointing board members, setting strategic goals, and overseeing financial performance. The subsidiaries, on the other hand, focus on their core operations, whether that's manufacturing, retail, or technology development. This separation ensures that each company can specialize in its area of expertise while benefiting from the broader strategic vision of the holding company.

Another cool thing about holding companies is their ability to consolidate resources. By pooling financial assets, they can negotiate better terms with suppliers, secure more favorable loans, and even share administrative functions like HR and IT. This not only cuts costs but also enhances efficiency across the board. Plus, when it comes to mergers and acquisitions, holding companies have the flexibility to acquire new businesses without disrupting their existing operations. It's like adding new tools to your toolbox without having to rebuild the entire shed.

Types of Holding Companies

Not all holding companies are created equal. There are different types, each serving a specific purpose in the corporate world. Let's take a look at some of the most common ones. First up, we have the pure holding company. This type focuses solely on owning and managing subsidiaries, without engaging in any business activities of its own. It's like the ultimate delegator, letting the subsidiaries do all the heavy lifting while it sits back and calls the shots.

Then there's the operating holding company, which is a bit of a hybrid. It not only owns subsidiaries but also engages in its own business activities. This model is often used by companies that want to expand into new markets or diversify their product offerings. For example, a tech company might establish a holding company to manage its various startups while continuing to develop its core technology. It's like having your cake and eating it too.

Read also:The Outpost Armory Your Ultimate Destination For Tactical Gear And Firearms

Financial Holding Companies

Now, let's talk about financial holding companies. These are a bit more specialized, focusing on owning and managing financial institutions like banks, insurance companies, and investment firms. They play a crucial role in the financial sector by providing stability and ensuring compliance with regulatory requirements. Plus, they offer a wide range of financial products and services, making them a one-stop shop for all your banking needs.

And finally, we have the conglomerate holding company, which is like the ultimate corporate juggernaut. It owns subsidiaries across multiple industries, creating a diversified portfolio that can weather economic storms. Think of companies like Berkshire Hathaway, which owns everything from insurance to energy to consumer goods. It's like having a mini-economy under one roof, where each subsidiary contributes to the overall success of the holding company.

Advantages of Establishing a Holding Company

So, why would anyone want to set up a holding company? Well, there are plenty of advantages. First and foremost, it offers excellent risk management. By separating the holding company from its subsidiaries, you create a legal firewall that protects your assets in case one of the subsidiaries runs into trouble. This means that if a subsidiary goes bankrupt, the holding company and its other subsidiaries are shielded from the fallout. It's like having an insurance policy for your business empire.

Another big advantage is tax efficiency. Holding companies can often take advantage of tax treaties and incentives that wouldn't be available to individual subsidiaries. This allows them to optimize their tax liabilities and increase their bottom line. Plus, they can consolidate certain expenses, like research and development costs, across multiple subsidiaries, further reducing their tax burden. It's like finding hidden treasures in your financial statements.

Strategic Flexibility

But wait, there's more. Holding companies also offer unparalleled strategic flexibility. They can easily acquire new businesses, divest underperforming ones, and restructure their portfolios to adapt to changing market conditions. This agility is crucial in today's fast-paced business environment, where being able to pivot quickly can make all the difference. Plus, they can leverage their size and resources to negotiate better deals and partnerships, giving them a competitive edge in the marketplace. It's like having a Swiss Army knife for your business strategy.

Challenges and Considerations

Of course, nothing is perfect, and holding companies are no exception. One of the biggest challenges is the complexity of managing multiple subsidiaries. Each subsidiary has its own set of challenges, from regulatory compliance to cultural differences, and coordinating all of them can be a logistical nightmare. It's like trying to herd cats, but the cats are businesses with their own personalities and agendas.

Then there's the issue of transparency. Holding companies often face scrutiny from regulators and shareholders who want to ensure that they're not engaging in any shady practices. This means they need to maintain high standards of corporate governance and disclosure, which can be time-consuming and costly. But hey, if you want to play in the big leagues, you gotta follow the rules.

Cost Implications

And let's not forget about the cost implications. Setting up and maintaining a holding company can be expensive, especially if you're dealing with multiple jurisdictions and regulatory requirements. You'll need a team of lawyers, accountants, and other professionals to ensure everything is in order. Plus, there's the cost of acquiring and integrating new subsidiaries, which can eat into your profits. It's like building a house—you gotta have a solid foundation before you start adding rooms.

Real-World Examples of Successful Holding Companies

Okay, let's talk about some real-world examples of holding companies that are killing it in the corporate world. First up, we have Alphabet Inc., the parent company of Google. Alphabet is a classic example of a holding company that uses its structure to innovate and diversify. By separating Google's core search business from its other ventures, like self-driving cars and biotech, Alphabet can focus on long-term projects without worrying about short-term profits. It's like having a lab where you can experiment without fear of failure.

Then there's Berkshire Hathaway, run by the legendary Warren Buffett. Berkshire is a conglomerate holding company that owns a diverse portfolio of businesses, from insurance to energy to consumer goods. Its success is built on a combination of smart investments, strong management, and a long-term perspective. It's like having a treasure chest filled with gold, but instead of gold, it's filled with successful businesses.

Lessons from the Best

What can we learn from these successful holding companies? First, they emphasize the importance of having a clear strategic vision. Whether it's Alphabet's focus on innovation or Berkshire's commitment to value investing, these companies know what they want to achieve and stick to it. Second, they prioritize strong governance and transparency, ensuring that all stakeholders are kept in the loop. And finally, they're not afraid to take calculated risks, knowing that failure is part of the process. It's like playing chess, where every move is carefully thought out and executed with precision.

Steps to Establish a Holding Company

So, you're thinking about setting up your own holding company? Great idea! But where do you start? First, you need to identify the assets you want to hold. This could be existing businesses, real estate, intellectual property, or even cash reserves. Once you've identified your assets, you'll need to create a new legal entity to act as the holding company. This involves filing the necessary paperwork with the relevant authorities and setting up a board of directors.

Next, you'll need to transfer ownership of your assets to the holding company. This can be done through stock purchases, asset transfers, or other legal mechanisms. It's important to get this step right because it will determine the tax implications and legal structure of your holding company. You might also want to consider setting up separate subsidiaries for each business or asset class to further protect your interests. It's like building a fortress, where each wall adds an extra layer of security.

Legal and Regulatory Requirements

Now, let's talk about the legal and regulatory requirements. Depending on where you're setting up your holding company, you'll need to comply with various laws and regulations. This could include corporate governance standards, tax regulations, and industry-specific rules. It's a good idea to work with a team of legal and financial experts to ensure everything is in order. Plus, you'll need to establish internal controls and reporting mechanisms to maintain transparency and accountability. It's like having a roadmap that guides you through the complexities of the corporate world.

Conclusion: Why Understanding Holding Companies is Crucial

Alright, let's wrap this up. Understanding holding companies is crucial for anyone looking to navigate the complex world of business. Whether you're an entrepreneur, investor, or corporate executive, knowing how holding companies work can help you make smarter decisions and achieve greater success. They offer unparalleled flexibility, risk management, and strategic advantages that traditional business models simply can't match.

So, what's next? If you're ready to take the plunge and set up your own holding company, remember to do your research, consult with experts, and stay focused on your goals. And if you're just starting out, consider sharing this article with your friends and colleagues to help them understand the power of holding companies. Who knows? You might just inspire the next Warren Buffett or Larry Page. Now go out there and build your empire!

And hey, don't forget to leave a comment or share this article if you found it helpful. Your feedback means a lot to us, and it helps us improve our content for future readers. Thanks for sticking around, and we'll see you in the next one!

Table of Contents

- What Exactly is a Holding Company?

- Types of Holding Companies

- Advantages of Establishing a Holding Company

- Challenges and Considerations

- Real-World Examples of Successful Holding Companies

- Steps to Establish a Holding Company

- Conclusion: Why Understanding Holding Companies is Crucial